Personal Loans Canada Things To Know Before You Get This

Personal Loans Canada Things To Know Before You Get This

Blog Article

The Buzz on Personal Loans Canada

Table of ContentsGetting The Personal Loans Canada To WorkThe Main Principles Of Personal Loans Canada The Facts About Personal Loans Canada UncoveredHow Personal Loans Canada can Save You Time, Stress, and Money.The Greatest Guide To Personal Loans Canada

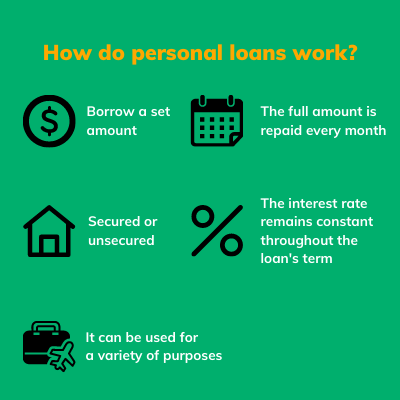

Allow's study what an individual lending actually is (and what it's not), the reasons individuals use them, and how you can cover those insane emergency situation costs without handling the concern of debt. An individual loan is a round figure of money you can borrow for. well, practically anything., yet that's practically not an individual loan (Personal Loans Canada). Individual loans are made with a real economic institutionlike a financial institution, credit report union or online loan provider.

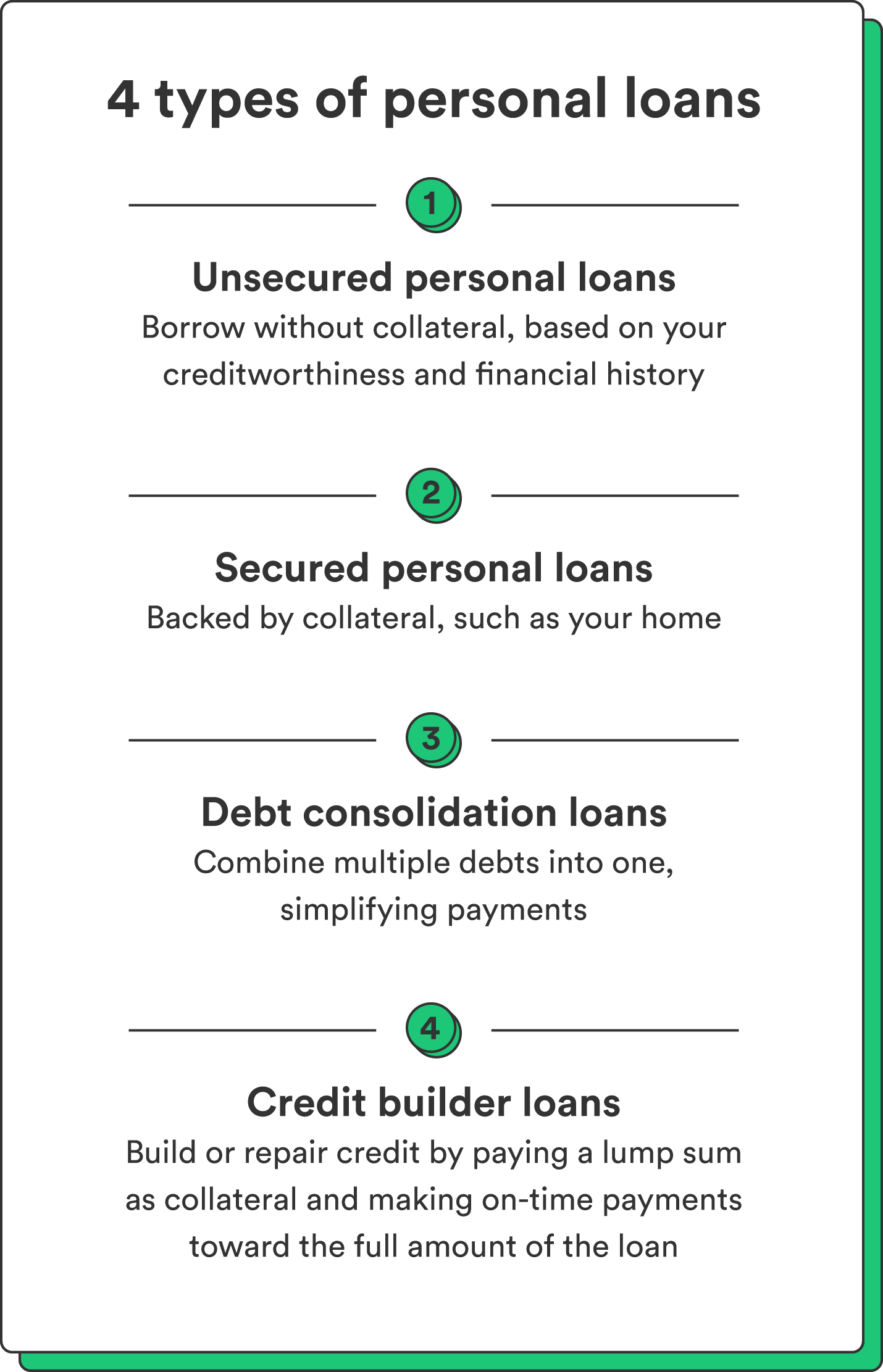

Allow's take an appearance at each so you can know precisely how they workand why you don't require one. Ever before. Most personal financings are unprotected, which means there's no collateral (something to back the loan, like an auto or house). Unprotected fundings commonly have higher rate of interest and need a far better credit history since there's no physical product the loan provider can remove if you don't pay up.

What Does Personal Loans Canada Do?

No issue exactly how excellent your debt is, you'll still have to pay passion on a lot of personal finances. Safe individual financings, on the various other hand, have some type of collateral to "secure" the finance, like a watercraft, jewelry or RVjust to name a couple of.

You could also take out a secured personal funding utilizing your cars and truck as security. Count on us, there's nothing protected about secured car loans.

Just because the settlements are predictable, it does not suggest this is a good deal. Personal Loans Canada. Like we said previously, you're practically assured to pay interest on a personal financing. Just do the math: You'll wind up paying method extra in the lengthy run by obtaining a funding than if you would certainly just paid with money

The 20-Second Trick For Personal Loans Canada

And you're the fish holding on a line. An installment car loan is an individual funding you pay back in taken care of installations over time (typically as soon as a month) till it's paid completely - Personal Loans Canada. And don't miss this: You have to pay back the initial financing amount before you can borrow anything else

Don't be mistaken: This isn't the exact same as a debt card. With individual lines of credit rating, you're paying interest on the loaneven if you pay on time.

This one gets us riled up. Due to the fact that these services prey on people that can't pay their costs. Technically, these are short-term lendings that offer you your paycheck in breakthrough.

The 6-Minute Rule for Personal Loans Canada

Because things get my explanation real unpleasant actual fast when you miss out on a payment. Those creditors will certainly come after your pleasant granny that cosigned the financing for you. Oh, and you need to never cosign a loan for anyone else either!

All you're truly doing is using new debt to pay off old financial debt (and prolonging your loan term). Firms know that toowhich is specifically why so many of them supply you debt consolidation loans.

And it starts with not obtaining any type of even more cash. Whether you're assuming of taking out an individual loan to cover that kitchen remodel or your overwhelming credit score Discover More card costs. Taking out financial debt to pay for points isn't the means to go.

7 Simple Techniques For Personal Loans Canada

And if you're taking into consideration an individual finance to cover an emergency situation, we get it. Obtaining cash to pay for an emergency situation only intensifies the stress and challenge of the circumstance.

Report this page